How To Find Out Sort Code And Account Number Santander

It's important to stay in control of your credit card business relationship and your repayments to avoid paying fees and charges. Nosotros've got a multifariousness of tips, guidance and tools to help you.

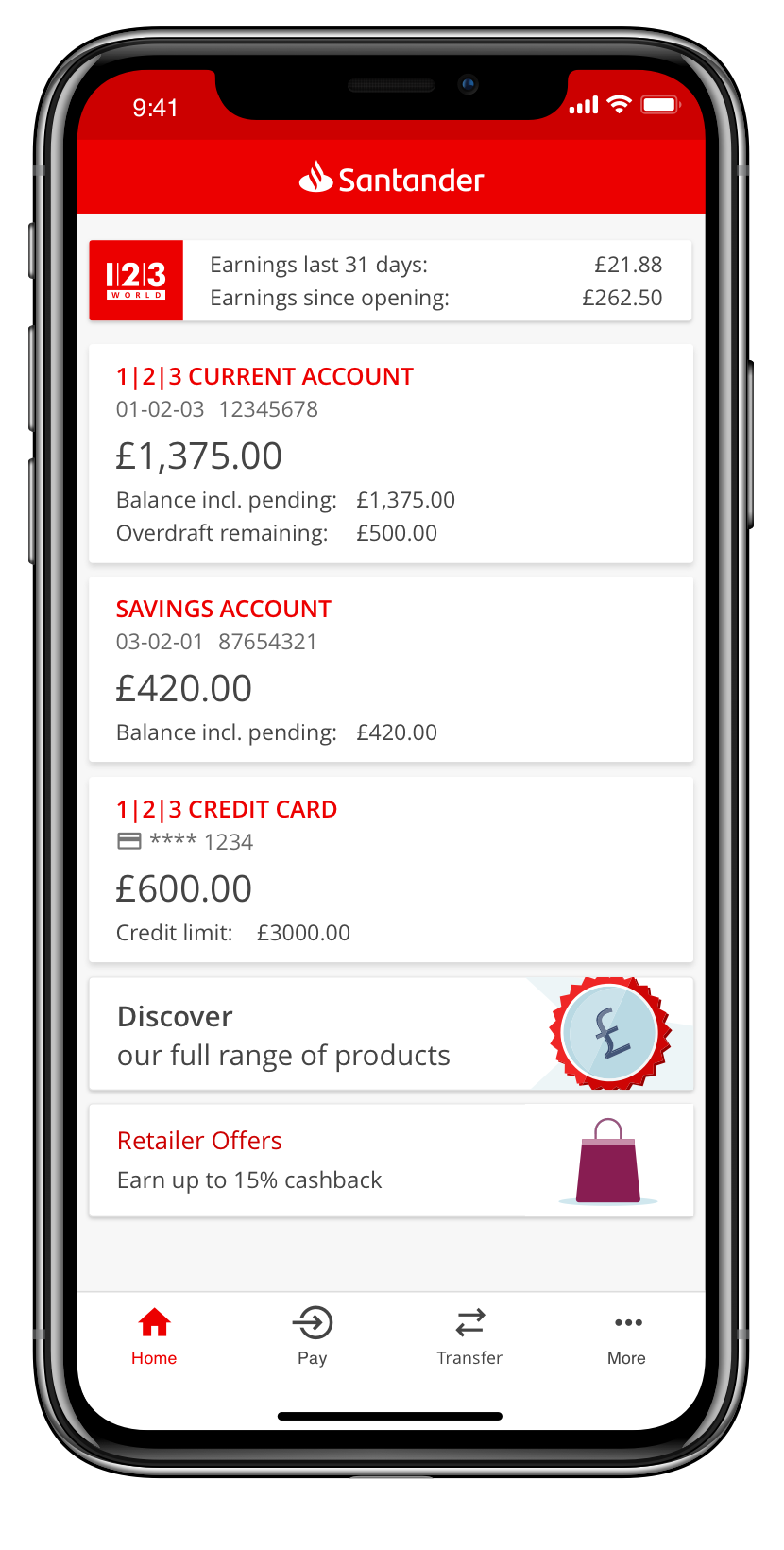

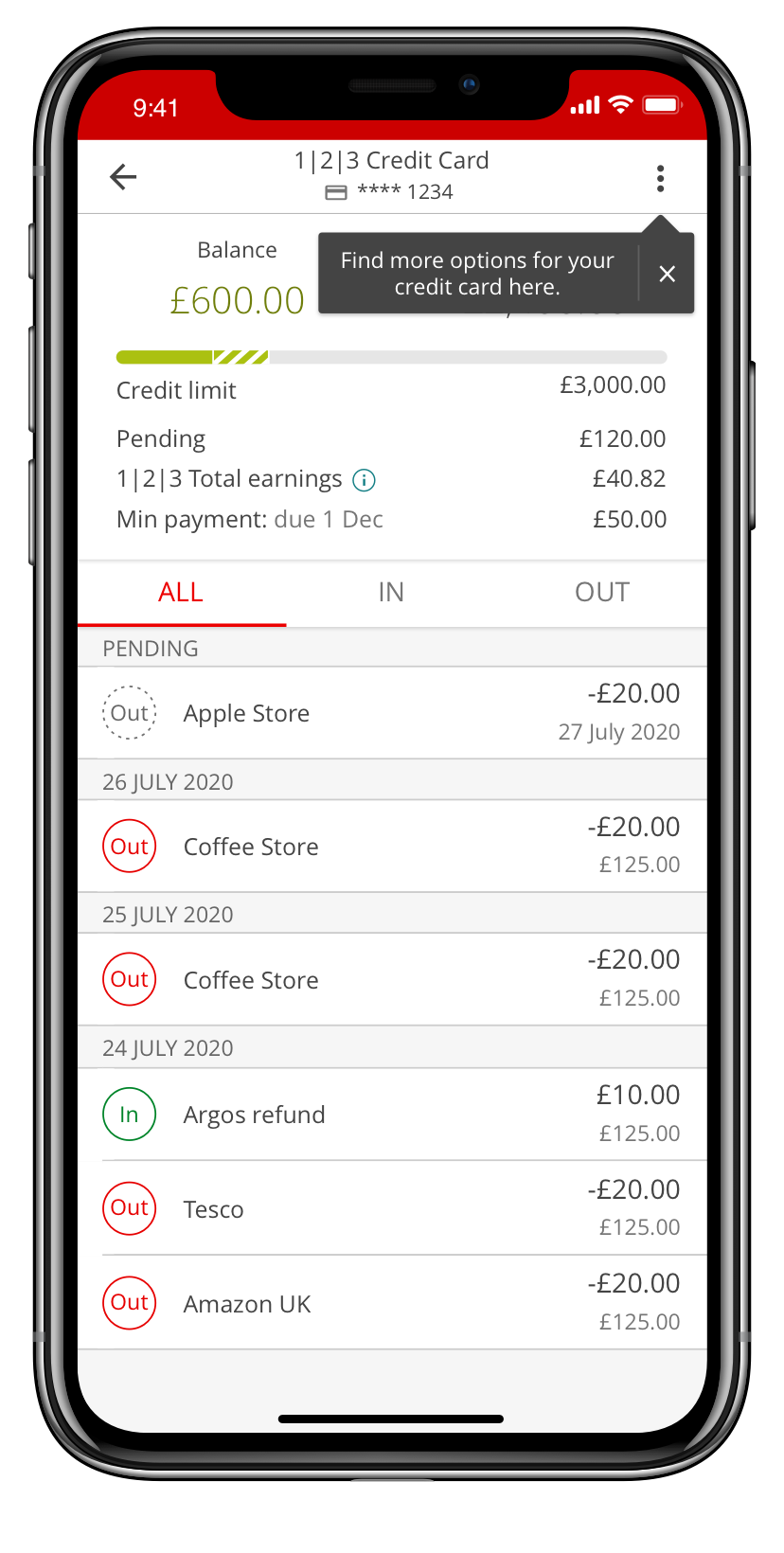

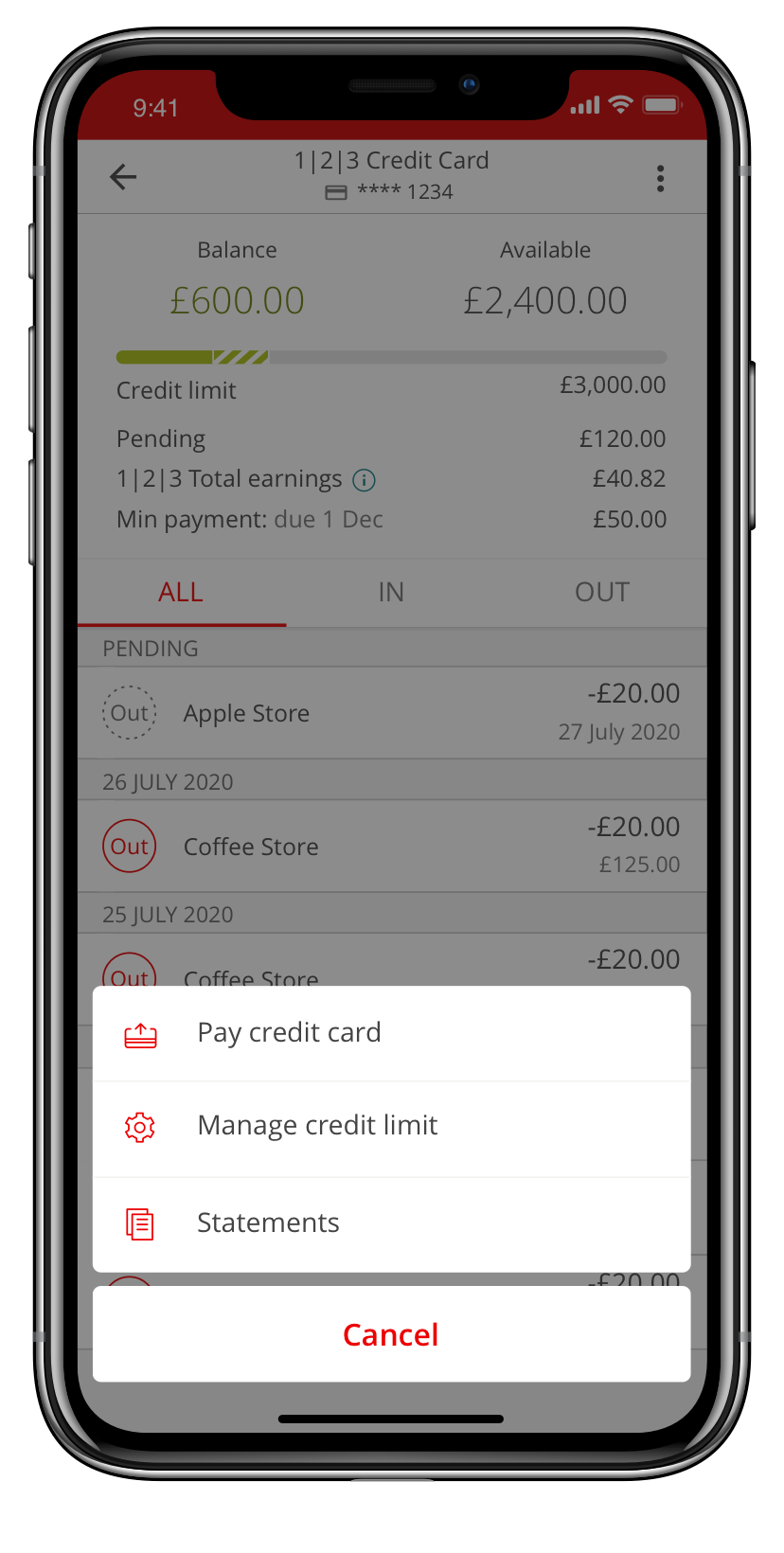

Mobile Cyberbanking

An easy fashion for you lot to make payments to your Santander credit carte is with Mobile Cyberbanking.

Simply log on and follow these steps.

1

Choose the credit bill of fare you want to pay

ii

Tap on the 3 dots in the pinnacle-right corner

3

Pick 'Pay credit card' and cull how much y'all want to repay

If you need more detailed stride-by-step instructions on how to brand payments to your credit menu within Mobile Cyberbanking, take a await at our mobile demo

Contact the states

Notwithstanding having problem? Contact united states

You can pay your Santander credit carte du jour using your current business relationship by setting upward a 'new payment' in Online Banking

You'll need the following details:

- Sort code: 09-00-99

- Account number: 01000007

Reference: your 16-digit Santander credit card number (essential to make sure payment reaches your business relationship).

Every bit an Online Cyberbanking client, you can make Direct Debit payments to your credit card. You tin likewise brand one-off payments by logging on to Online Cyberbanking, choosing 'Pay Santander Credit Bill of fare' and entering your debit bill of fare details.

Don't have a debit carte du jour? Don't worry, yous can still register for Online Banking with your credit card.

Setting up a Directly Debit is the hassle-gratis fashion to pay your credit card bill. It will take a few minutes to do in Online Banking and will so happen every calendar month without y'all having to do annihilation farther.

You lot can gear up your Directly Debit to pay in 1 of 3 ways.

- Full payment: which pays off the entire balance each month.

- Minimum payment: a percentage of your balance which we crave you to pay each month. It's shown on your argument.

- Fixed payment: an corporeality that you decide to pay each month.

If you do already have a Directly Debit set up to pay your credit carte balance, you could increment the amount you pay each month to pay off the residue more speedily. This will besides reduce the total amount of involvement you pay.

You tin can run into the corporeality yous're currently paying on your statement. Run into the 'your statement explained' section for guidance on where to notice this data.

How to set up or change a Direct Debit:

- Log on to Online Banking

- Click on the Credit cards tab in the top card

- Click gear up/better Direct Debit - on the left paw side

- Choose the amount you desire to repay each month (total payment, minimum payment or stock-still payment)

- Type the sort code and account number of the current account yous want to make the payments from - this can be not-Santander account

How long will a Directly Debit take to prepare up?

It takes virtually a calendar month to set up a Direct Debit and so if y'all need to make a payment to your credit menu in the meantime, you'll demand to pay your credit card using another method which y'all can find on the dorsum of your statement.

You can alsocontact united states of america to set or modify a Directly Debit.

Log on to Online Banking

Take a look at our Online Banking video guides to acquire more.

Making extra 1-off payments when you lot take the coin tin assist you lot clear your credit menu debt more apace. The easiest fashion to do it is past using Online or Mobile Banking, where you can pay from your Santander current account. If you don't have a Santander current account, you lot tin can prepare a bill payment from any other Uk bank.

You'll demand these details:

Sort code: 09-00-99

Account number: 01000007

Reference: your 16 digit Santander credit card number (essential to make certain payment reaches your account)

To get the maximum affect from a 1-off payment, we recommend you brand it upwards to 5 working days before the Direct Debit is taken (you'll observe your Direct Debit claim appointment on the 'Business relationship Summary' page of your statement). This mode, the one-off payment will be taken as well as your Directly Debit.

Alternatively, if you make the one-off payment outside the higher up timings the amount will reduce down your Direct Debit amount and won't exist on top of your usual payment.

Log on to Online Banking

These are the general fees and charges for your credit card. You can find the specific fees and charges for your carte du jour on the back of your statement.

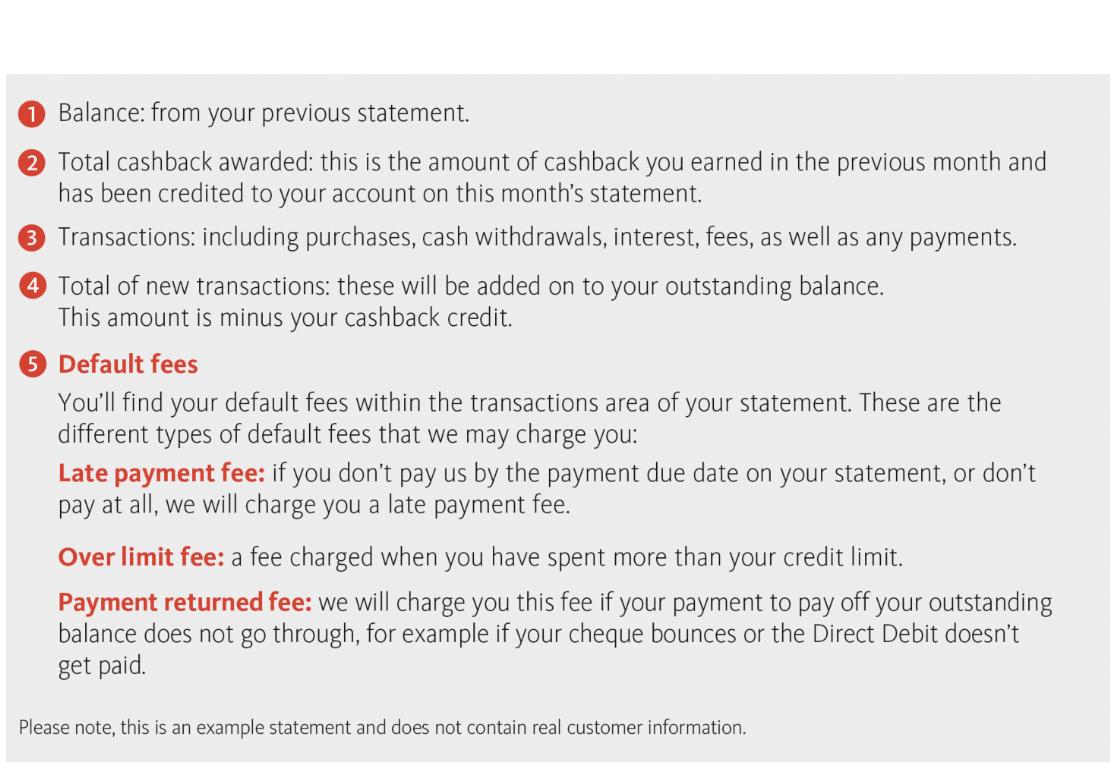

If you don't pay usa by the payment due date on your statement, or don't pay at all, we'll charge you a £12 late payment fee.

A £12 fee charged when y'all have spent more than than your credit limit.

We'll accuse you a £12 fee if your payment to pay off your outstanding balance does non go through, for case if your cheque bounces or the Direct Debit doesn't go paid.

Other credit card interest rates and charges

Cash transactions include withdrawing money from a cash machine, buying foreign currency, purchasing lottery tickets or using your card for gambling.

Interest is charged from the date the cash transaction is added to your account – there's no interest-costless period on cash transactions. So even if yous pay your balance in total on your argument appointment, you'll still exist charged involvement on any greenbacks transactions.

A fee may as well exist charged for greenbacks transactions.

If you transferred a balance during a 0% offer, y'all'll be charged interest at your standard rate on any balance remaining after the 0% interest offer ends.

If yous transfer a balance at any other time, you lot'll pay a residuum transfer fee and interest will exist charged at the standard purchase rate.

Your standard interest charge per unit is printed on your monthly statement. This is the involvement that you'll exist charged if you're not in a 0% involvement offering menstruation.

If you have a 0% offer, y'all'll be charged interest at your standard rate on any purchase rest remaining afterward the 0% interest offering ends.

If you utilise your carte du jour for new purchases afterwards the 0% offer catamenia ends, you'll go up to 56 days involvement free if you pay your full residue on time and in full each month.

If you don't pay your residual in full, you'll be charged interest on new purchases, too every bit whatever remaining buy balance.

Your standard interest rate is printed on your monthly statement. This is the interest that yous'll be charged if you're not in a 0% offer period.

When yous use your carte du jour away you may exist charged additional fees and involvement for making not-sterling transactions. There may also be fees to withdrawing cash away. Find out more than in our travelling guide.

The payments yous make pay off items that are already on your statement before paying off any more contempo transactions. These recent transactions are the ones made since the concluding statement was issued.

Payments are allocated to the transactions on your statement that have a higher involvement charge before those incurring lower interest. For case, a greenbacks withdrawal will exist paid off before an introductory 0% interest offer because it has a higher involvement rate but this only happens in one case the transaction has been applied to your statement.

Set up account alerts to help avoid fees and accusesouth

We'll transport you alerts when you're near your credit limit to help you lot avoid fees and to make you aware of certain activity on your account. Y'all tin manage your alert settings through Online Banking, or by contacting us.

Observe out more about account alerts

Stay up-to-engagement on the go with Mobile Banking

Check your credit menu rest, make payments to your card, view your credit limit and more with our mobile cyberbanking app.

Stay inside your credit limit

Your credit limit can be found on your monthly statement and in Online or Mobile Banking. If y'all spend over your limit you'll be charged an over limit fee. You can manage your credit limit preferences in Online Cyberbanking

Avoid using your credit card for cash withdrawals

If you use your credit card to take out greenbacks from cash machines, you'll be charged interest from the day you withdraw the money. This differs from interest on purchases, every bit you have 56 days before that is applied. To avoid any involvement charges from a cash withdrawal, you need to pay off the entire existing residuum and any outstanding interest as soon as the cash withdrawal is made. If you don't, you'll be paying interest on the amount of cash you took out until your balance is cleared.

Change your payment date to suit you

You can choose a user-friendly date to have your credit card Directly Debit payment taken. Contact u.s.a. to change your payment date.

Check your rates and fees

Take a expect at the 'understanding fees and charges' section. Keeping in mind what yous'll be charged may help yous spend less. You lot can also notice useful information on the relevant product folio on our website, and also in our credit cards guide (447 KB)

Your credit carte du jour statement is available in Online and Mobile Banking. If you're not yet paper-free, we'll too send y'all a paper argument each month showing all your recent transactions, including your minimum payment and the date its due.

Yous can switch to newspaper-free anytime within Online Banking.

If yous'd like to modify your payment due date and the engagement we send you your argument, please contact us

To help you lot get the best from your argument, we've designed a uncomplicated guide.

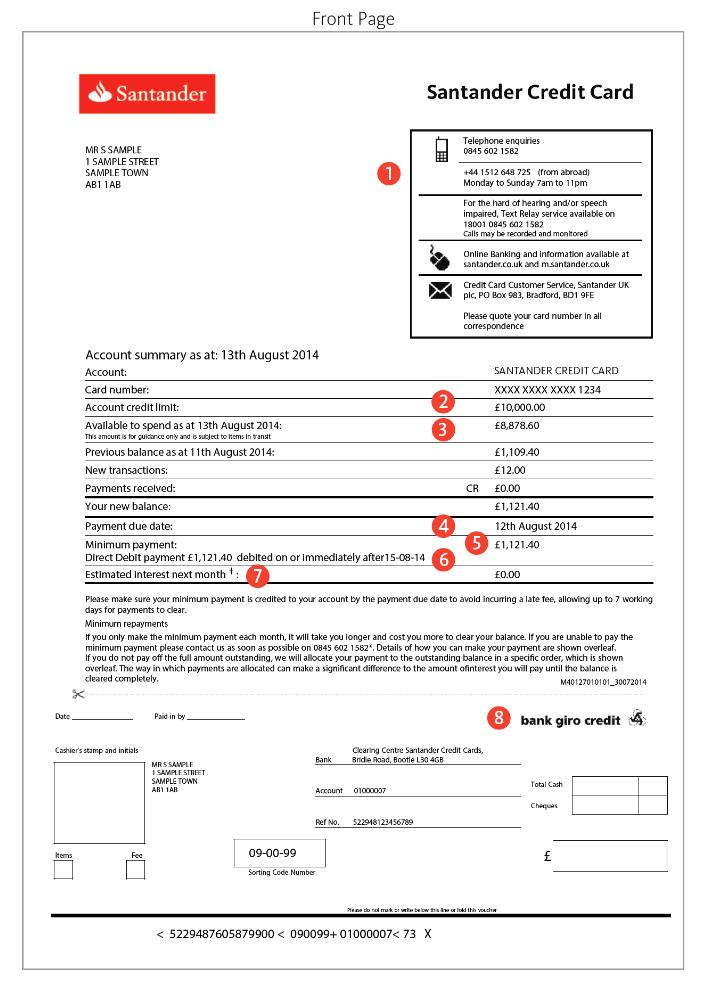

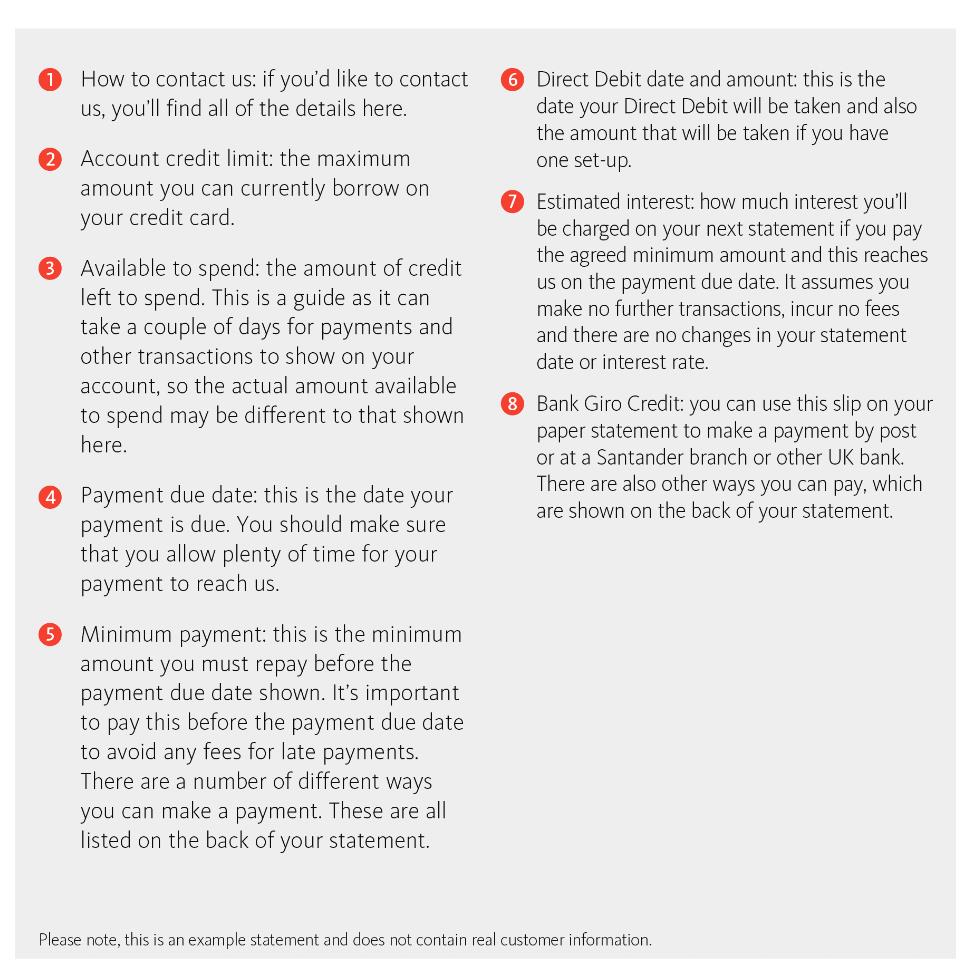

Front page of your printed argument:

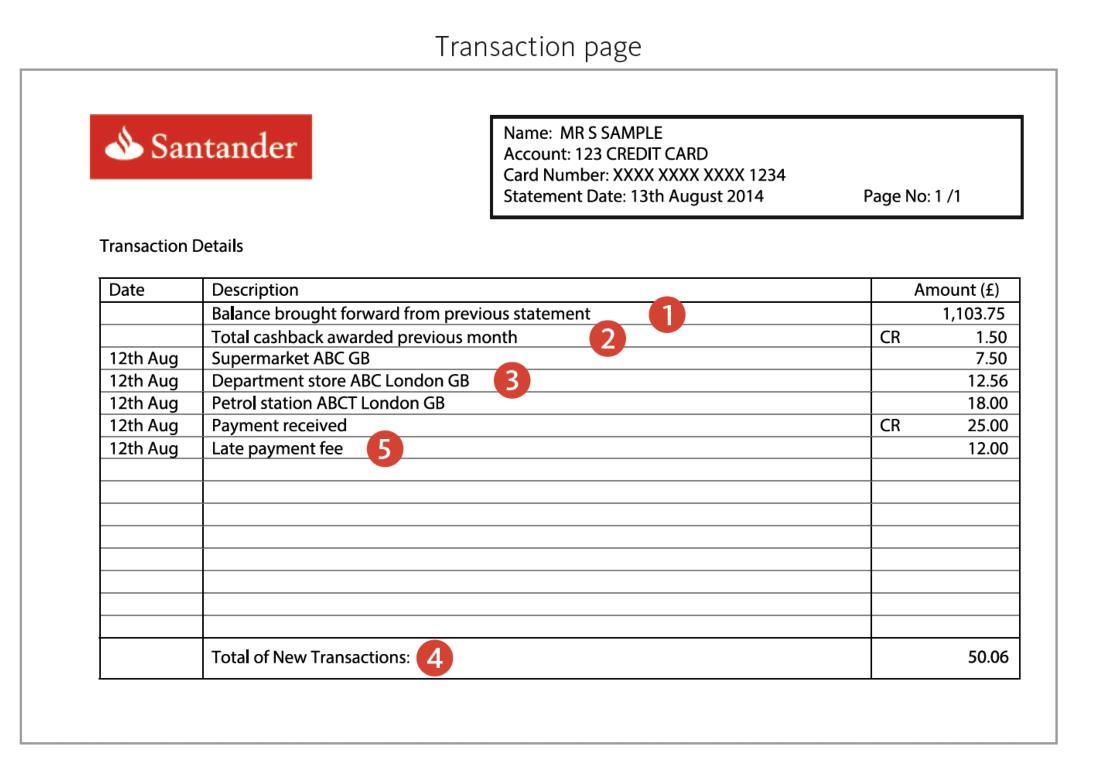

Transaction page of your printed statement:

A credit carte isn't ideal for long-term borrowing, simply a personal loan could help you consolidate your debts into 1 monthly repayment at a fixed charge per unit. Detect out more about other borrowing options

What is 'persistent debt'?

The regulator has introduced new rules and guidance to aid credit card customers. If you make minimum or low payments over a period of xviii months or longer, y'all may pay more than in interest, fees and charges on your credit carte than the amount you have paid towards what y'all have borrowed. This may exist referred to equally 'persistent debt'.

If you're in persistent debt, you lot'll receive a letter or email from us, with options on how you can repay your balance.

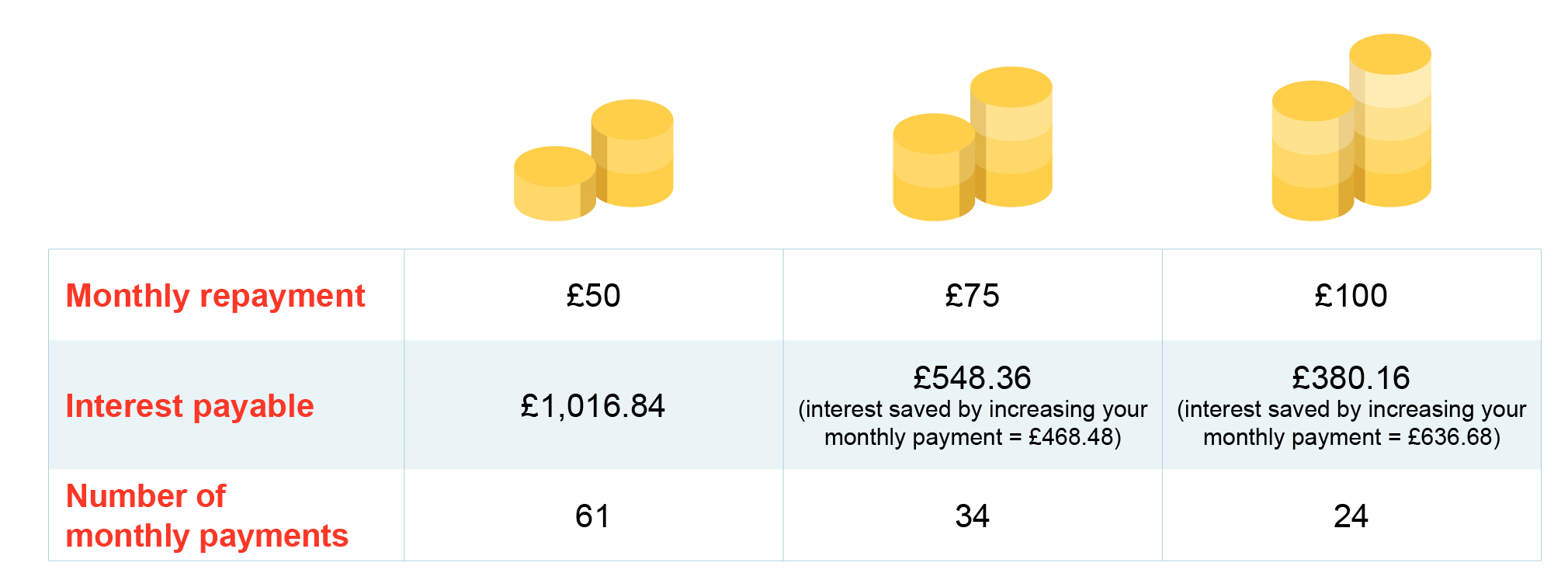

Paying more per month will relieve yous interest and reduce the time that it takes to pay off your balance

Here's an example of how an increment in payments reduces the interest and the repayment period on a credit carte balance of £2,000 with an APR of 18.nine%

What do I need to do?

The simply manner to avoid this blazon of debt is to pay off more than than the minimum payment, and really, as much as you lot tin. This way you'll relieve money on interest charges and repay your debt in less time. However, if you've received a letter of the alphabet or an e-mail from us to tell y'all you've been in persistent debt for three years, you'll need to accept activity by the date we've provided.

If y'all can afford to, i of the ways that might help your account out of persistent debt is to brand a one-off boosted payment.

How can I brand an additional payment?

Log on to Online Cyberbanking and make a payment from either your Santander current business relationship or from an account with another banking company or building society.

Gear up up a new payee from the Santander Mobile Banking app and make a payment. Yous'll need the following details:

Sort code: 09-00-99

Business relationship number: 01000007

Reference: your sixteen digit Santander credit carte number

You lot can also set a bill payment from another United kingdom bank or building society using the details in option 2. You'll need to contact your depository financial institution to practise this.

You tin can too make greenbacks and cheque payments over the counter in any of our branches, provided you have your credit carte details to hand. Y'all'll need to allow one working 24-hour interval for cash payments to clear and seven working days for cheques to clear.

You may also desire to consider:

- Taking out a loan to pay off your balance. If y'all tin can have out a personal loan charging less interest than your carte du jour yous'll accept one monthly repayment at a fixed rate.

- If you've received a alphabetic character to say y'all've been in persistent debt for 36 months and you're because a loan, please call us on 0800 032 8911.

Have a expect at our borrowing options

What happens if my menu is in persistent debt for 36 months?

We'll inquire you to brand a payment past a particular date. This engagement volition be sent to you lot on a letter or email. If y'all don't make a payment by this date your card volition exist blocked.

Y'all'll need to ensure the persistent debt balance is paid back within a maximum of 4 years - we'll provide you options on your letter or email.

Accept a expect at the Persistent Debt for 36 months page for more data on how you can prevent your carte from being blocked.

If you're worried about your finances, please visit our money worries page for further support.

At that place are also a number of organisations detailed below that tin give you costless impartial debt advice.

These organisations aren't linked with Santander and they can help you manage your creditors and debt problems. Please note that some of these organisations may charge for their services.

Business organisation Debtline

bdl.org.united kingdom of great britain and northern ireland

Cardcosts from Britain Finance

cardcosts.org.uk

Citizen's Advice Bureau

adviceguide.org.uk

Money Advice Service

moneyadviceservice.org.great britain

National Debtline

nationaldebtline.org.uk

Payplan

payplan.com

StepChange Debt Charity

stepchange.org

Ask us a question

We'll help you get the

answers you lot need

Do your banking online

Means for you to manage your

money without leaving home

Source: https://www.santander.co.uk/personal/support/credit-cards/your-credit-card-repayments

Posted by: benoithoughle.blogspot.com

0 Response to "How To Find Out Sort Code And Account Number Santander"

Post a Comment